Return on Investment: Annualized vs Simple percentage gains

To monitor your performance over the long term or against benchmarks

like the Nifty, the annualized return is more informative because it describes

the performance in consistent, annual terms.

The last few years have been good

for your investment portfolio. Some of your mutual fund investments have done

exceedingly well. But knowing that your investment has doubled (i.e. grown 100

percent) is meaningless unless you know over what period this took place --

doubling over 5 years indicates it has grown at a rate of 14.86 percent a year,

doubling over 10 years means it has grown at 7.17 percent a year, while

doubling over 15 years means it has grown at only 4.73 percent a year.

The 'Rule of 72' is a simplified way to determine how long an

investment will take to double, given a fixed annual rate of interest. By

dividing 72 by the annual rate of return, investors can get a rough estimate of

how many years it will take for the initial investment to duplicate itself.

There are two ways to calculate

gains:

1. Simple

percentage return or return on investment

2. Annualized

percentage gain

1. Simple

percentage return or return on investment: This is the

simple percentage gain of your holdings over the total investment amount, not

annualized as in the IRR calculation. Simple percentage return works over any

time period. It simply indicates the change from one point in time to another.

Simple % return = (Current Value-Amount invested) / (Amount invested) X

100

For an investment that lasts

exactly one year, the simple percentage return is the same as the internal rate

of return (IRR) below.

2. Annualized

percentage gain: Annualized return or internal rate of return (IRR) is

used show how an investment has performed over time. IRR calculates the

percentage return on an annualized basis regardless of the actual investment

period. It doesn't matter whether you hold an investment for one year, five

years, or even fifty years - the internal rate of return will tell you the

annualized percentage returns of that investment over any period of time.

To get an accurate picture of your

performance over the long term or against benchmarks like the Nifty, the

internal rate of return is more informative because it describes the

performance in consistent, annual terms.

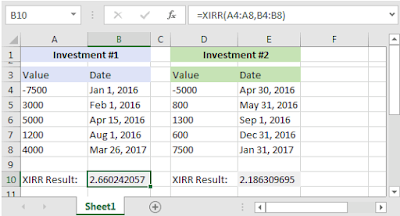

How do I compute annualized gains? The easiest way to do these

challenging calculations is in Excel using the XIRR function – you need to have

the investment dates, investment amounts and the current value handy.

The Microsoft Excel XIRR function

returns the internal rate of return for a series of cash flows that may not be

periodic. Because you provide the dates for each cash flow, the values do not

have to occur at regular intervals.

The XIRR function is a built-in

function in Excel that is categorized as a Financial Function. It can be used

as a worksheet function (WS) in Excel. As a worksheet function, the XIRR

function can be entered as part of a formula in a cell of a worksheet.

Which one should you use? At the

end of the day, each calculation is useful in its own way. To monitor your

performance over the long term or against benchmarks like the Nifty, the annualized

return is more informative because it describes the performance in consistent,

annual terms. However, for determining your gains over a shorter period or

understanding your cash-on-cash returns, the simple percentage return is easier

to calculate and gives you everything you need. Simple percentage gains works

better in the short-term for investments such as equity funds that have more

ups and downs. Annualized percentage gains should be used for almost everything

else, and over all time periods more than a year.

Your broker, distributor or

investment adviser should be able to share the annualized percentage gains

(IRR) and simple percentage gains for your investment portfolio – ask for both

these numbers to find your true portfolio performance!

Comments

Post a Comment